venture capital

Which is the Better Source for Startup Capital?

Every budding start-up comes across the same big question as its revenue starts to grow, “Is it time to seek funding from a Venture Capital Firm?” The answer may vary depending on the type of company and the economic conditions surrounding the forecasted growth of the startup. One aspect that every entrepreneur must do is evaluate whether they actually need VC funding or if they should go after the likes of an angel investor, private equity investor and maybe even a business incubator. In recent times, crowdfunding has been all the talk. After all, why would a company elect to give up a percentage of their company when they can simply give away their product to “investors”. The only reason why crowdfunding has not taken over the venture capital world is because the JOBS Act has not yet been approved. Crowdfunding and Venture Capital funding have their positives and negatives and they must be assessed before considering accepting an offer.

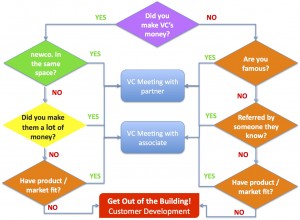

Some Great Startup Advice from Sequoia Partners